-

Error-Free Salary Processing

-

Automated Tax & Deductions

-

Stress-Free Compliance

Payroll & Compliance Automation simplifies complex payroll operations by automating salary calculations, tax deductions, and statutory contributions. With accurate computations, errors are eliminated, and employees receive timely payouts. The system automatically updates with the latest tax and labor regulations, ensuring organizations remain compliant at all times. HR teams save significant time by avoiding repetitive manual processes, while employees gain confidence in the transparency of their pay structure. This solution fosters trust, minimizes disputes, and allows companies to focus on growth instead of administrative bottlenecks

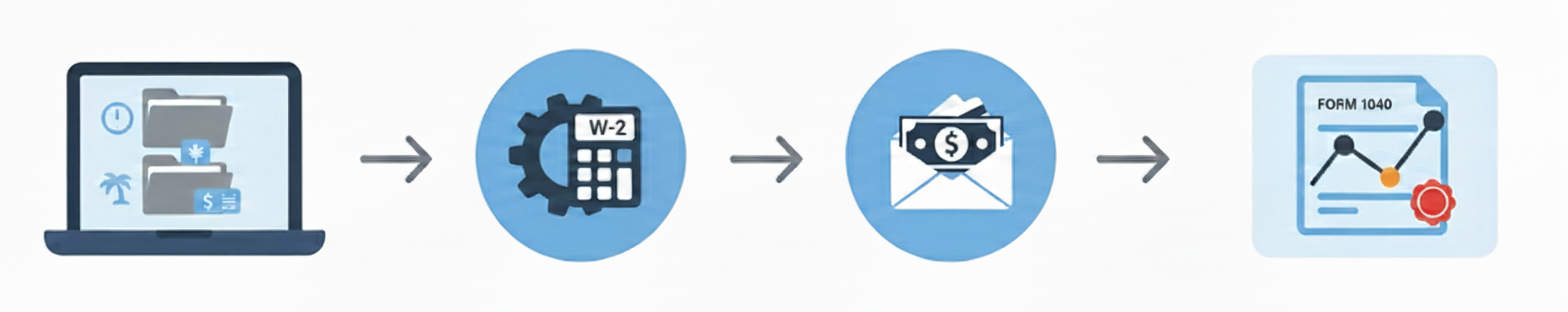

How It Works?

Consolidate Data

The system collects attendance, leave, and compensation data in one place.

Auto Calculate

Wages, taxes, and deductions are automatically calculated to prevent errors.

Direct Deposit

Salaries are securely processed and paid directly to employee accounts.

Compliance Filing

The system automatically generates and files tax and regulatory documents.

Benefits for Businesses

Error-free salary calculations and payouts

Automated tax deductions and filings

Reduced HR workload and processing time

Full compliance with statutory regulations

Questions? We'll put you on the right path.

Ask about Fieldcloud products, pricing, implementation, or anything else. Our highly trained reps are standing by, ready to help.

Schedule Demo